Cfo Company Vancouver for Beginners

Table of ContentsThe Ultimate Guide To Outsourced Cfo ServicesThe Greatest Guide To Tax Consultant VancouverAll about Pivot Advantage Accounting And Advisory Inc. In VancouverThe smart Trick of Vancouver Tax Accounting Company That Nobody is Talking AboutGetting The Cfo Company Vancouver To WorkSmall Business Accounting Service In Vancouver Can Be Fun For Everyone

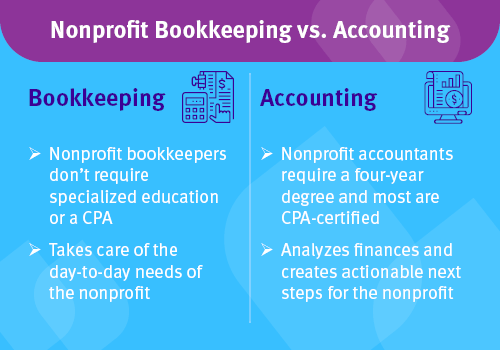

Here are some benefits to working with an accounting professional over an accountant: An accountant can give you a detailed view of your organization's financial state, along with methods as well as referrals for making monetary decisions. At the same time, accountants are just liable for recording financial transactions. Accountants are called for to complete even more education, certifications and also work experience than bookkeepers.

It can be hard to gauge the proper time to hire a bookkeeping professional or bookkeeper or to determine if you require one in all. While several tiny businesses work with an accountant as a consultant, you have several choices for managing economic jobs. As an example, some small company proprietors do their very own accounting on software application their accounting professional recommends or uses, offering it to the accounting professional on a weekly, monthly or quarterly basis for activity.

It might take some background study to locate an ideal accountant because, unlike accountants, they are not needed to hold an expert accreditation. A solid recommendation from a trusted coworker or years of experience are essential variables when employing a bookkeeper.

Cfo Company Vancouver Things To Know Before You Get This

For local business, adept money administration is a crucial facet of survival and also growth, so it's important to collaborate with an economic expert from the beginning. If you prefer to go it alone, take into consideration beginning with accountancy software application and also maintaining your publications diligently approximately date. That method, need to you need to work with an expert down the line, they will have exposure into the complete economic history of your organization.

Some source meetings were performed for a previous version of this short article.

The smart Trick of Vancouver Tax Accounting Company That Nobody is Talking About

When it concerns the ins as well as outs of tax obligations, accounting and finance, nonetheless, it never hurts to have a knowledgeable professional to turn to for assistance. A growing number of accountants are also dealing with things such as capital projections, invoicing and HR. Eventually, a lot of them are handling CFO-like functions.

Small company proprietors can anticipate their accounting professionals to aid with: Choosing the service structure that's right for you is vital. It affects exactly how much you article source pay in taxes, the paperwork you require to file and your individual responsibility. If you're looking to convert to a different company structure, it can lead to tax repercussions and also various other complications.

Also firms that are the exact same dimension and also sector pay extremely different amounts for accountancy. These expenses do not transform into cash, they are needed for running your service.

9 Easy Facts About Small Business Accountant Vancouver Described

The ordinary price of bookkeeping services for tiny company varies for every one-of-a-kind situation. Because bookkeepers do less-involved jobs, their prices are typically less expensive than accountants. Your economic service charge depends upon the work you need to be done. The typical monthly accountancy fees for a local business will rise as you add extra services and the jobs obtain tougher.

You can record transactions and process pay-roll utilizing on the internet software. You get in amounts into the software application, as well as the program computes totals for you. Sometimes, payroll software for accountants permits your accountant to use payroll handling for you at very little added expense. Software program options can be found in more helpful hints all sizes look at this web-site and shapes.

The Ultimate Guide To Cfo Company Vancouver

If you're a new organization proprietor, don't fail to remember to factor bookkeeping expenses right into your spending plan. Management expenses and also accounting professional fees aren't the only accounting expenditures.

Your time is likewise beneficial as well as ought to be taken into consideration when looking at accounting prices. The time spent on accounting jobs does not produce revenue.

This is not planned as lawful guidance; for additional information, please go here..

The smart Trick of Vancouver Tax Accounting Company That Nobody is Talking About